Recently one of my friends was shocked to see outstanding income tax demand appearing in e-Filing portal of the income tax department, though according to him, entire tax dues are paid.

‘Oh Mind, Relax please!’ is the title of a book written by Swami Sukhabodhananda. If you are an income tax assessee and even if you have filed your return up to date, we must say that ‘Oh mind, don’t relax please! Once the return is filed, you may say “Yes, it’s done for this year’ isn’t it? Sorry, you may have to do some more homework! When you have time, just login to your account in income tax e-filing portal and see whether any outstanding income tax demand is appearing in your account!

So, my first reaction to him was ‘Don’t worry’ the department is updating the software and there may be errors from their end too.

(Read: How to file online rectification of income Tax Application u/s 154 of Income Tax act 1956)

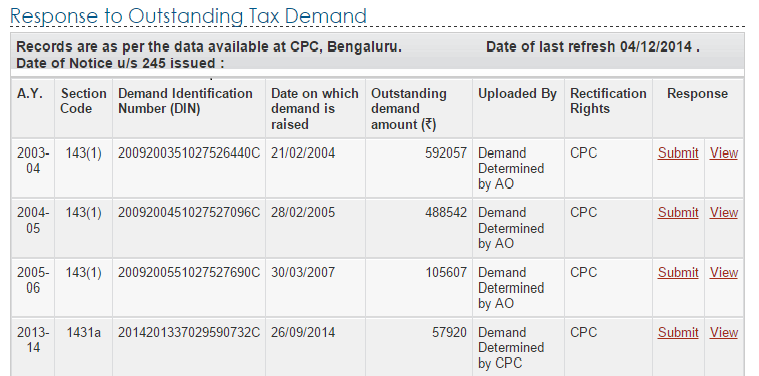

When you look at e-portal, it may appear as under

The tax demand may arise on account of many simple reasons. Say for example, while filing the return you would have wrongly / not fed the right information or the department would not have considered the rectification filed by you u/s 154 for the previous assessment years.

Now that the Income Tax e-portal is becoming more and more user-friendly, they are enabling more features which will help the taxpayers to rectify the mistakes online.

How to check outstanding Income tax demand amount in the e-Filing portal?

Login to your account in income tax e-portal and check “My Pending Actions” in the dashboard.

Step by step procedure to handle outstanding demand –

Ascertain the nature of Income Tax Demand: First and for most thing, you have to ascertain the reason for raising demand. You will get the information from Intimation received u/s 143(1) of Income tax Act.

If you have not received intimation u/s 143(1) you can visit Income Tax E-Filing Website and request for re-sending of Intimation u/s 143(1) / u/s 154 .

Pay Undisputed Tax: If the department is right in raising the tax demand, simply pay it! (Note: If you won’t pay, then department will adjust the outstanding dues against refunds, if any)

Rectify Mistake apparent on record: If you are not satisfied about the demand amount, you have the option of filing rectification application seeking rectification of mistake in the order passed by CPC/AO.

File Revised Return if required: In case demand rising by the department is due to incorrect filling of data, go ahead and file a revised return. Fresh/additional claim of deduction under chapter VIA or loss cannot be accepted in rectification. In such cases you can file revised return.

Submit response to Outstanding Tax Demand

After following above steps ie after payment of undisputed tax demand and filing rectification/revised return where ever required, you can submit your response to outstanding tax demand.

The detailed process to submit the response to Outstanding Tax Demand is as below:

- Login to www.incometaxindiaefiling.gov.in and check Refund/Demand status menu.

- If there is any outstanding tax demand, the “Response to Outstanding Tax Demand” will appear showing demand amount along with A.Y. for which demand exists.

- You can submit your response by selecting correct option. Option available is – 1. Demand is correct 2. Demand is partially correct and 3. Disagree with demand.

- If you select demand is correct then you cannot disagree with the demand letter.

- If you select other options i.e. demand is partially correct or disagree with demand, you will have to provide reasons for exercising the option along with documentary evidence.

- Based on the reason selected, the assessee needs to provide additional information as below

- Demand Paid: BSR Code, date of payment, serial no, Amount. If challan doesn’t have serial no you will have to upload challan.

- Demand already reduced by rectification/Revision/Appeal: Upload rectification order passed by AO and provide information on date of order, pending demand amount after rectification, etc.

- Rectification / Revised Return filed at CPC: If you have filed rectification for the demand amount, provide acknowledgement No of rectification application filed online. In case if you have filed revised return, you need to provide e-Filed acknowledgement No of the revised return.

- Rectification filed with AO: If you have filed rectification application manually to the jurisdictional assessing officer, provide date of filing application.

- Once assessee submits the response, transaction id will get generated which can be viewed later.

- Other Points:

- If demand is shown to be uploaded by AO in the above table, rectification right is with Assessing Officer, you have to contact your jurisdictional Assessing Officer for rectification.

- For the demand against which there is “No Submit response option” available such demand is already confirmed by the Assessing Officer. You have to contact your Jurisdictional Assessing officer for rectification if needed.

- If you have any concern on return processing by CPC, you can submit your grievances online. For details you can check our other article Tax Payer can submit online grievance relating to CPC and efiling of Income tax Return

Is it necessary to respond to the outstanding demand appearing in e-Filing Portal?

Yes, if you fail to submit response to any of the demand appearing in e-Filing portal, subsequent refund if any due to you will be adjusted against outstanding demand amount. Further department may initiate proceedings to recover the demand amount.

You can download, Income tax department manual on Response to Outstanding Tax Demand, to know detailed process of submitting the response to outstanding tax demand. We have compiled frequently asked question (FAQ) on CPC Communication on processing of Income Tax Return and filing of Rectification application.

Did you face problem of outstanding demand? Comment your experience in the comment section at the end of the article.

Should you need any assistance in addressing issue on Demand appearing in income tax portal with Bangalore income tax jurisdiction, please do contact us at prakasha@balakrishnaandco.com

Simplified Laws Guide to Taxation and Legal Concern

Simplified Laws Guide to Taxation and Legal Concern

I have an Outstanding demand raised for the A.Y. 2014-15, I missed the intimation before. I think intimation was for mistmatch with my PAN address and my Entered address in the ITR. I have paid all my taxes properly. How do I go about this situation now? I have already exceeded 1 year from the intimation. Please kindly advice me on this situation.

please help

have got outstanding tax demand for the assessment year 2014-15, when I filled the ITR1, I forgot to include section 80C and others. Now I have disagreed the amount. I tried filing revised return but it is not allowing me to efile for that year. I am getting notifications from income tax department. Please advice how to rectify this..,how i can show my savings for that year.

Hi Team,

i have got outstanding demand of 320(2015-2016) on online portal and i have submit it as correct and paid this amount. so do i need to fill itr again as rectification or correction ?

Thanks in advance

Dear Sir

I have paid pending demands for AY 2010-11 and 2011- 12 and interest thereon u/s 220(2). Do i need to file revised returns for these years or these cases shall be settled by department of its own.

Google

Check beneath, are some totally unrelated internet sites to ours, nevertheless, they may be most trustworthy sources that we use.

2019

2019

HI sir,

I have received 143(1) with demand to pay tax of amount 2440 which was already paid by me at the time of filling tax.

To reply for demand i had login to my account and clicked on Response to Outstanding Tax Demand but i got the result as no records found.

Please guide me regarding this issue.waiting for your response

Thanks in advance

Hi, I had a demand for 36k and I paid it online. But the very next day I again got a demand of 17k for the same assessment year. Why is it? Also where can I see the details of the payment I made

Such a nice blog.

I have read an amazing article here.

… [Trackback]

[…] Find More Informations here: simplifiedlaws.com/check-outstanding-income-tax-demand-efiling-portal/ […]

I enjoyed your wonderful blog.

Thank you for the very hard work done.

mamba3

http://mamba3.com

Google

Here are a few of the websites we advocate for our visitors.

Google

…

There was a demand notice in the efiling webpage for Ay 201-11. obviously they have misplaced my my income tax return. After some reminde I got a phone call asking me to send copy of return. I have sent them. It is six month since I have sent the copy of the return. In spite of repeated reminders,so far it appears no response and the demand continues in the efiling webpage. I do not like to appeal to higher authorities as the the AO may be displeased. I am a very old man and I would like to dispose this case in any case before my death.

What should go in the remarks field while rectification request is done for partially correct and e-filed rectification request? Also I lost my TDS certificates and they are unobtainable because I switched jobs. Can I submit response without uploading anything?

‘@r@r_jha:disqus

You don’t need to file revised return

Hello @vishalkumarmehta:disqus

Revised income tax return can be filed by an assessee any time before the expiry of one year from the end of the relevant assessment year. For the asst year 2014-15 you have time till 31st March 2016 for filing revised return.

I suggest you to file revised return by considering deduction u/s 80C. If you wish our help, you can send information to team@simplifiedlaws.com

You don’t have to file revised return or rectification application if you have paid outstanding demand by selecting code 400 in the challan. Amount will get deleted after two or three days of making payment from the portal

Sir

I have paid income tax outstanding demand of YA 2009-10 But there don’t have any submit link please tell me how can i fix that this is my email id-anrbnghsh@gmail.com

I filed my original ITR for 15-16 on 22.08.2015 and got a refund of 50,200. But after receiving refund I noted some mistake in my original return, so I filed a revised return submitted it and e-verified also . According to revised return I should have got a refund of Rs. 30,200 instead of 50,200 i.e I have received an extra refund of Rs. 20,000. What should I do? Should I wait for a demand from Income Tax Deptt. for extra amount refunded by them or should I pay Rs. 20,000 as self assessment tax? Please advice soon

Demand raised date is shown as17/11/10, have not received any intimation u/s 1431 a till now. Wrote to AO to send me intimation copy on 10 Nov, 14 but no response till now. My query:

1. Upto what date I can file rectification?

2. If I do not get response from A.O in time, then how to get rectification done?

Regards,

Joginder. Sud

Dear Sir,

On filing my returns for AY 2015-16, I received a communication from CPC, Bengaluru under section 245 that my return has been processed and has resulted in some refund.

But, it shall be adjusted against ‘out standing demands of Rs1120 and Rs 800’ for the AY 2010-11 and 2011-12 under section 154 and 1431a respectively uploaded by jurisdictional AO which is ITO W-4, Panchkula.

I never received any notice / intimation either from ITO or CPC , Begaluru in this regard nor do I know how these outstanding amount have been arrived at.

I checked up Form 26AS for these years but there is no outstanding amount indicated therein.

I also submitted request at Income Tax Website for supplying intimation under the relevant sections for these AYs but they also indicated that there is no such information

I shall be thankful to you if you can guide me to enable me get the required information and how to proceed further.

Should not be there any time limit to raise demands for previous years and hold processing of returns/refunds for the current year on account of such outstanding demands which have not even been intimated.

I contacted my AO regarding an outstanding demand for previous AY 2010-11 along with the documentary proofs like my treasury salary slip, form-16 issued by DDO, ITR-V for return filed by me for the said AY 2010-11,but I was told to contact my DDO regarding this or to fulfill the demand by depositing the tax required. What should be done now when the tax is duly deposited and there is no dues on my side? Whether non-filing of form24q for the ay 2010-11 by my DDO may be the reason for this outstanding demand? If yes then who is liable for penalty?

i have filed a ITR-1 SAHAJ for getting the refund from the tax payable. i hve filled the form with all the details of advance tax paid with challan no., bsr code , etc and also recieved a intimation. the intimation is showing the net outstanding tax payable as the previous tax which should be deducted from the advance tax paid for the refund.I have submitted the response to the outstanding demand as demand is correct. Had I chosen the correct option??..Is getting a outstanding demand in the case of any refund is completely okay??…plz reply …:(

Hi There, I have a query regarding the outstanding income tax demand raised by AO for the A.Y. 2012-13. Recently I have submitted my returns thru efiling. When I was checking for the refund status under my pending actions I can see one outstanding demand. For which I didn’t get any intimation also I have paid the tax for that financial year thru a tax assistant. Now when I am trying to resend the intimation request, it is saying no intimation requests for that year.Please see below screen shots. Kindly guide me how to proceed further.

Hi, I have demand for AY2011-12, this is for whole tax amount i had paid through my employer (TDS) and i had filed ITR correctly. Even tax amount is correctly reflecting in online Form26AS.

So, can some one help me to understand why such tax credit is not been provided to me when its already correctly mentioned in my respective ITR, as well as its showing correctly on Form26AS?

Apart, subject demand is now with AO, but also i am surprised, till last year it wasnt notified to me not any trace of communication available in Incometax website/account. I came to know about same only when last years refund was debited against this outstanding demand & it was mentioned in my refund statement. I had submitted my dis-agreement through portal but yet no feedback from AO.

pls. advice what to do??

Hi,

Need help please:

I have not got clarified on further action for my demand notice on FY2014-2015.

I have submitted Rectification request using link in the portal, got successully with Transaction acknowledgement.

Now

to proceed with furrther on Tax Demand notice- response, there are

multiple options in “Disagree Demand Notice”. Is it otherwise, I need to

re-submit revised ITR again? and attach the latest e-file ack here? or

if I upload above rectification-Transaction ID snapshot file is fine?

I need help!

AY 14 ( financial

year 2013-2014). I receive mail from IT department “Demand Status at CPC as on

31-07-2015” for demand amount Rs 31130.00. For this I updated “Response to

outstanding tax Demand” as “Demand partially correct”. In that case I identified

that I have to pay Rs. 1310.00 (total demand Rs. 31130.00 , already paid Rs. 29820.00,

reaming amount 1310.00). The same I updated in my Response in tax website.

Again, Aug’15, I received “Intimation under section 245 of

Income Tax Act, 1961” for the same demand amount Rs. 31130.00. this time they

update The Outstanding demand pertains to the AY #2014 and Assessment

Year: 2015-16.

My confusion is :

I am ready to pay that reaming amount of rs 1310.00 ( challan 280) but what I have to do after

that payment .

Ø For which financial year?

Ø Which form I have to submit to IT again, is there any rectification / revised IT

return form? Can I pay the balance amount and upload revised return form once

again for FY 2013 -2014?

Ø And how I have to response on this section 245 request, because I already responded once in my previous demand.

Your advice would be highly appreciated. Please advice.

Hello,

I filed for income tax return recently. I had filed for a refund of a certain amount that was wrongly deducted as senior citizen privileges were not taken into account . Now I have an outstanding demand record in my efiling account. The corresponding mailer informs that “Your return has been processed at CPC and the same has resulted in refund. The refund so determined will be adjusted against the outstanding demand as shown in “Outstanding Demand table” annexed herewith.”

I am unsure how to take this forward. Will the amount be credited to my account or will it be deducted from the next years income tax.

Any help is appreciated.

Hello, i have a question regarding the outstanding tax demand. when i was filing for the first time for 2014-2015, filed my returns wrongly. so after two months i realized and filled again as revised. But when i recently checked , i am seeing my outstanding tax demand as 9700. so whatever the income i have declared in the revised has not reflected and the amount declared in the original is refelected asking me to pay 9700, how can this be rectified. kindly reply

Hi Team,

In the pending actions I just saw ‘Respond to Outstanding tax demand’. It seems i had filled ITR wrongly for that year. I have attached the screenshot. Please let me know what to do.

Thanks in advance!

dear sir/mam, by mistake i slect Demand is correct..but i am disagree with the demand..my all income and deduction is same as my assessment and undear 143()…but the difference is in TDS amount and intrest…as per the orignal return tds is-376140and as per s-141(1) the amount is 354667..

as per 26AS

tds for A.Y-2013-14 IS from 3 employee

1.354667

2.53760

3.30606

i also summit this issue to CPC, Income tax Department just 1 munite after this mistake

so, i request u to please help me

dear sir/mam, by mistake i slect Demand is correct..but i am disagree with the demand..my all income and deduction is same as my assessment and undear 143()…but the difference is in TDS amount and intrest…as per the orignal return tds is-376140and as per s-141(1) the amount is 354667..

as per 26AS

tds for A.Y-2013-14 IS from 3 employee

1.354667

2.53760

3.30606

i also summit this issue to CPC, Income tax Department just 1 munite after this mistake

so, i request u to please help me

There is an outstanding demand listed in my income tax e filling account for AY 2011-12 even if I have paid all the taxes and the same is reflecting in 26AS also. I disagree with demand and submitted the response on the portal that I disagree, but the demand is not getting removed and also I am not getting any response from the income tax department. Please suggest, how to resolve this.

The assessee has accepted the demand, but after consulting the CA he came to know that the demand was partial correct, can the reply submitted be revert back?

Hi, I recently logged into e-portal and say a demand raised for 29000. This demand was raised in Aug 2008. I recall that this should be for the year that I did not file my returns due to health issue and was job less. So no form 16 from any employer. Not that the demand is raised and I am seeing it for the first time. What needs to be done? Your advise in this regard will be highly appreciated. Thanks!

I have a question regarding the outstanding tax demand. For A.Y. 2012-13 i found a demand for 2440 rupees which I paid in 2013 year. However now i realised that I should select “400 – Tax on Regular Assessment” where as that time I selected “300 – Tax on Self Assesment” for “Type Of Payment”. Please let me know what I should do now to correct the same as it is still appearing in my Outstanding amount. Thank you.

Hi, I have received a demand under section 143(1) on 15/07/2015 for Rs 2200 (AY 2014-15). This is due to a tax credit mismatch for the same AY 2014-15. Do I have to deposit any interest on this demand even if I deposit the demand within 30 days of notice date?

If yes then from which date do I need to calculate the interest?

Regards,

I received Demand Notice from CPC for FY 12-13 and i paid INR 1700 , after 2 months received another Demand for Rs 4900 same was also paid by me. Now third demand of INR 20000 is raided for same financial year, which i am not finding correct. I am a salaried person and TDS is deducted by my employer , i paid self assessment tax on my income from other sources i.e Interest on my FDs etc.

Would like to know

1. Whom should i contact for my issue resolution

2. Is there a limit of demands raised by CPC for one Single year

I am seeing IT demand amount in e-portal = 55,000/- for an assessment year 2008-09. Strange things are,

1. My taxable income was only around 1LAC at that time.

2. This is raised in 2010

3. Didn’t get any notifications since 2010 about it

Why common people like us are facing such issues? and which may lead to trouble and deep trouble to visit AO offices for honest people.

Hi Team,

This is a very useful information and frankly come to know about this for the first time only. Besides that, can you please share an article to fill up the new itr form as it is asking for many information. Or do you think it is better to hire a third party e filing portal?

Your advise will be highly appreciated.

I have got outstanding tax demand for the assessment year 2011-12, when I filled the ITR1, I forgot to include section 80C and others. Now I have disagreed the amount. I tried filing revised return but it is not allowing me to efile for that year. I am getting notifications from income tax department. Please advice how to rectify this??

I had filled the rectification for the assessment year 2013-2014 , i had received the intimation letter u/s 245 which stated that, your refund should be adjusted against the demand for the assessment year 2014-2015.

I agreed with the demand and follow the demand process and submit it.

my question is after adjusting against the demand , when will be remaining amount refunded..

where i can see on the portal my demand is adjusted against my refund

My father’s account has old (not efiled) demands (under 1431a and 154). How do I get to know the details. When I click on resend, it says can’t find the orders.

Hello

I got notice 245 for the assessment year 2012-13 now.

The problem is selection of wrong challan Major head(0024 instead of 0021) , while I was paying the self assessment tax.

That was the difference in 143/1 intimation also.

Now I dont know how should I file online rectification for the same, Please help

I have filed returns online during AY 2009-10 & 2010-11. CPC has not processed it as some refund was there, hence transferred to AO. I did not get any notice from the AO. But now, it is appearing that there is some tax demand for the both the assessment years. I have submitted for rectification in the site and got a message that rectification rights with AO.

I am in receipt of intimation under section 143(10 which shows a demand of Rs. 1710. I agree with

the demand and i have accepted it online on the website. Website also says that if you accept the demand, it will adjusted against any refund in future. As of now i don’t have any refund outstanding.

Query is, after accepting the demand online, do i still need to pay the demand? Or I need not do anything as it will be adjusted by them automatically against any future refund.

Second query is, irrespective of answer to above query, let’s say i don’t pay the demand even after accepting it. Will interest continue to be levied on that? Or acceptance of demand itself is good enough and no further interest will be levied?

[…] Have you checked your Outstanding Income Tax Demand appearing in e-Filing portal? […]